Financial Analysis That Actually Makes Sense

Most business owners look at their numbers and feel lost. Cash flow confuses them. Balance sheets feel like a foreign language. But here's the thing – understanding liquidity and solvency isn't about being a financial genius. It's about knowing what to look for and when to pay attention.

Our program strips away the jargon and teaches you practical analysis that protects your business. No theory. No complicated formulas you'll never use. Just real skills that help you spot trouble before it arrives.

Start Your Journey in July 2026

What You'll Learn

This isn't about memorizing ratios. We focus on reading your business like an open book. You'll understand when cash is tight versus when you're genuinely in trouble. Big difference.

- Current ratio analysis that reveals immediate risks

- Quick ratio calculations for true liquidity assessment

- Debt-to-equity interpretation for long-term stability

- Working capital patterns that predict cash problems

- Interest coverage evaluation before it becomes critical

How It Works

Six months of focused learning. Weekly sessions run two hours each. We start with your actual financials – not textbook examples – so everything connects to your real situation.

- Live analysis workshops with real business data

- Monthly one-on-one reviews of your progress

- Access to financial modeling templates

- Industry benchmark comparisons for context

- Support between sessions via email

Who This Helps

Business owners who are tired of feeling blind about their finances. Maybe you've been caught off guard by cash crunches. Or perhaps you want to understand what your accountant is telling you. Either way, this program gives you clarity.

- Small business owners seeking financial confidence

- Entrepreneurs planning growth or expansion

- Managers responsible for department budgets

- Anyone considering business acquisition

- Professionals transitioning to business ownership

Your Instructors

We've spent years helping Australian businesses understand their numbers. These aren't academic theories – they're lessons learned from watching companies succeed and fail based on how well they understood their financial position.

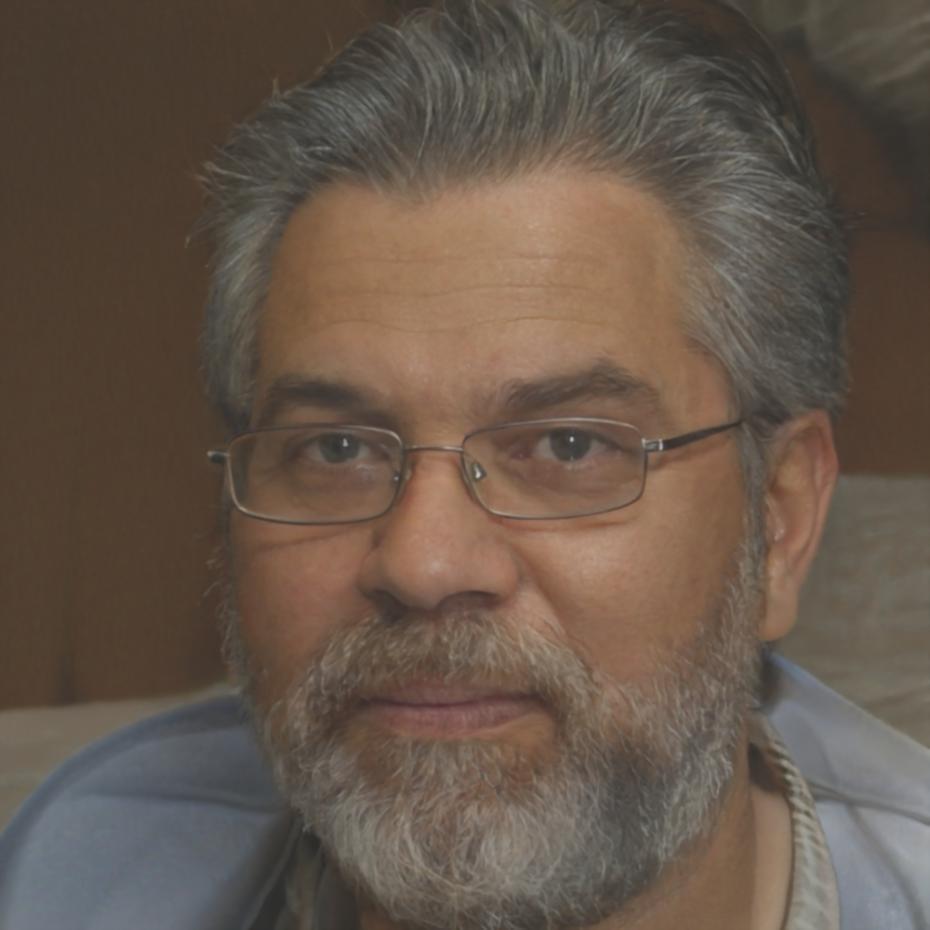

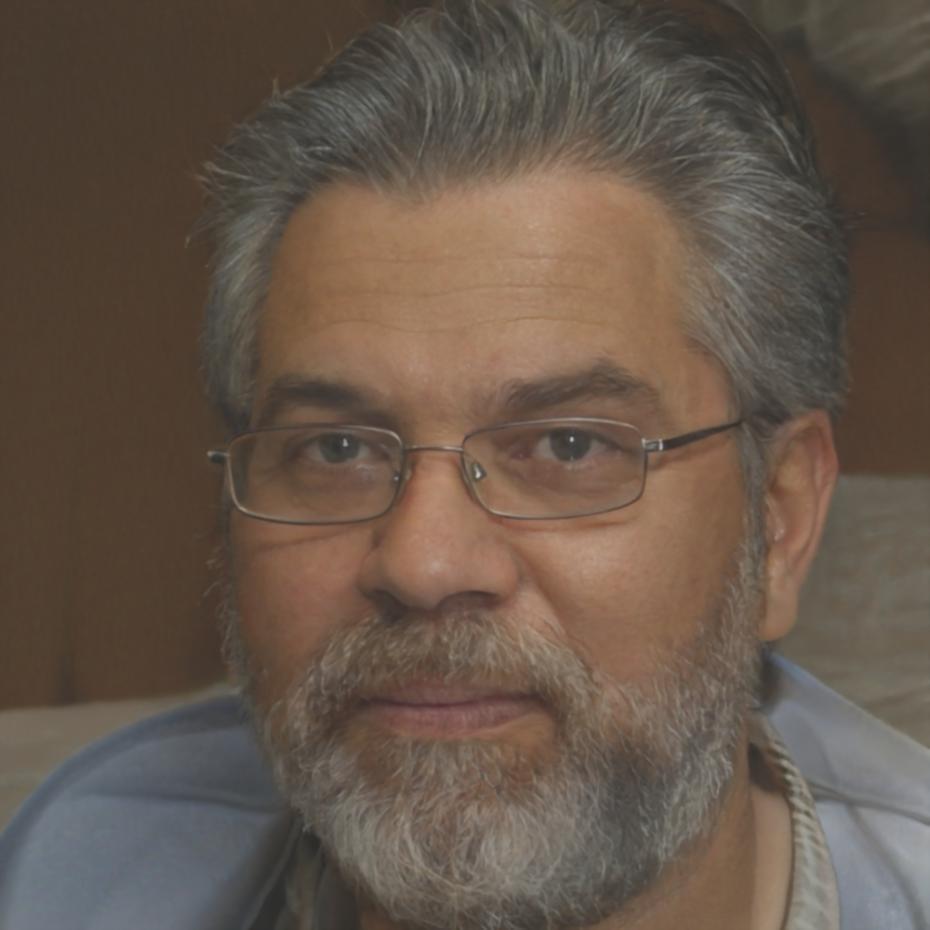

Vaughn Pembroke

Senior Financial AnalystTwenty years analyzing SME financials across retail, manufacturing, and services. Vaughn's worked through three economic downturns and knows what separates businesses that survive from those that don't. He'll show you the warning signs most people miss until it's too late.

Isla Thornbury

Cash Flow SpecialistIsla spent a decade at NAB business banking before going independent. She's seen hundreds of loan applications and knows exactly what lenders look for in your ratios. More importantly, she can explain complex concepts without making you feel stupid for asking questions.

Desmond Fairweather

Solvency ExpertFormer turnaround consultant who's been called in when businesses hit the wall. Desmond teaches the uncomfortable truths about debt levels and sustainability. His sessions on solvency analysis are blunt, practical, and genuinely eye-opening for most participants.

Margot Ashfield

Business StrategistMargot connects financial analysis to actual business decisions. She's run two successful ventures herself and understands the gap between knowing your ratios and using them to make better choices. Her practical approach helps you apply analysis in ways that matter.

Program Timeline

We run two intakes annually. The next cohort begins July 2026, with sessions every Tuesday evening. Each module builds on the previous one, so you'll develop confidence gradually rather than feeling overwhelmed.

Foundation Phase

Weeks 1-8 | July - August 2026Understanding basic financial statements and what they actually tell you. We cover the current ratio, quick ratio, and working capital in depth. By the end, you'll be able to assess short-term financial health with confidence.

Deep Analysis Phase

Weeks 9-16 | September - October 2026Moving into solvency indicators and long-term stability metrics. Debt ratios, equity positions, and interest coverage become clear. You'll learn to spot businesses heading toward trouble months before it becomes obvious to everyone else.

Application Phase

Weeks 17-24 | November - December 2026Taking everything you've learned and applying it to real scenarios. Case studies from actual Australian businesses. You'll analyze complete financial pictures and develop recommendations that make sense for different situations.

What Changes After This Program

The difference isn't just knowing more ratios. It's feeling confident when you look at financials. Understanding what your accountant means. Spotting problems early enough to fix them. Making decisions based on actual data rather than gut feeling.

| Skill Area | What You'll Master | Practical Application |

|---|---|---|

| Liquidity Assessment | Current and quick ratio interpretation with industry context | Know when cash concerns are temporary versus structural |

| Solvency Evaluation | Debt-to-equity and leverage analysis with risk indicators | Understand your safe borrowing capacity before approaching lenders |

| Cash Flow Reading | Operating, investing, and financing flow pattern recognition | Predict cash crunches three to six months ahead |

| Working Capital | Components analysis and trend identification | Optimize inventory and receivables without strangling operations |

| Comparative Analysis | Benchmarking against industry standards effectively | Know if your ratios indicate genuine problems or sector norms |

Successful Program Completion

Manufacturing Business Owner"I was running my business blind for eight years. Had an accountant who gave me reports I couldn't interpret. Three months into this program, I spotted a working capital issue developing and addressed it before it became critical. That alone paid for the course several times over."

Practical Skills Development

Retail Chain Manager"The solvency analysis module changed how I look at expansion decisions. We were considering opening three new locations. After calculating our actual debt capacity and coverage ratios properly, we scaled back to one location and kept our financial position stable. Probably saved us from serious problems."